The Issue Is …

“The privilege of creating and issuing money is not only the supreme prerogative of Government, but it is the Government’s greatest creative opportunity. By the adoption of these principles, the long-felt want for a uniform medium will be satisfied. The taxpayers will be saved immense sums of interest, discounts and exchanges. The financing of all public enterprises, the maintenance of stable government and ordered progress, and the conduct of the Treasury will become matters of practical administration. The people can and will be furnished with a currency as safe as their own government. Money will cease to be the master and become the servant of humanity. Democracy will rise superior to the money power.”

“The privilege of creating and issuing money is not only the supreme prerogative of Government, but it is the Government’s greatest creative opportunity. By the adoption of these principles, the long-felt want for a uniform medium will be satisfied. The taxpayers will be saved immense sums of interest, discounts and exchanges. The financing of all public enterprises, the maintenance of stable government and ordered progress, and the conduct of the Treasury will become matters of practical administration. The people can and will be furnished with a currency as safe as their own government. Money will cease to be the master and become the servant of humanity. Democracy will rise superior to the money power.”

— Abraham Lincoln

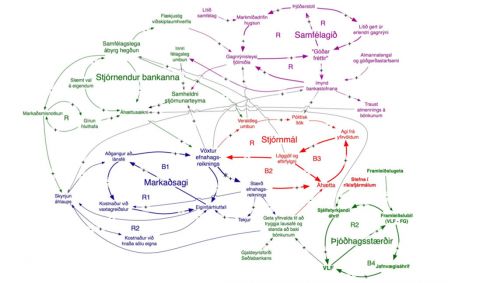

We are hard at work handing this power over to the European Central Bank

which is as far removed from democratic control as the rest of the criminal cartel.

The constitutional assembly has just made this transfer easier.

If a blind man leads a blind man, both will fall into a pit. (Matthew 15:14)

The Lost Science of Money

“Conspiracy” from the Congressional Record

The 13 Trillion Dollar Demonstration of Creativity

“Saving” the Bankrupt Banking Cartel at the Cost of Nations

–

Nobel descendant slams Economics prize

“Super” Mario a GS pro who turned tricks on Greece

Congressman Dennis Kucinich

Top 10 Media Manipulation Strategies

–

They call it representative democracy

Clarke & Dawe: Laughing as you sink!

Before It’s News